Leasing

We have multiple Leasing Options available – flexible enough for anyone!

In addition to preserving precious working capital and bank lines of credit, leasing programs for equipment purchases offer many benefits including:

- Lease payments are generally 100% tax deductible – IRS Section 179 Tax code allows

businesses to deduct the full purchase price of qualifying equipment - Can be used to purchase new & used equipment – often, a portion of the installation and shipping costs can also be rolled into lease.

- Interest rates are fixed so that long-term floating rates can be avoided.

- Business budgeting and planning are simplified with fixed lease costs

We partner with a number of finance companies to offer flexible, Application-Only leasing programs for our US and Canadian customers.

- Wide credit ranges accepted (FICO scores 590 – 800+)

- Same day approvals

- $5,000 Minimum

- 24, 36, 48 & 60 month options

Give us a call at 800-453-8639 or email us (info@washbaysolutions.com) and we can first give you some lease estimates. If they fit within your budget, we will put you in contact with our friendly lease professionals.

North Carolina

Headquarters

At WashBaySolutions.com, we have been specializing in high tech, custom-engineered solutions to complex washing and wastewater issues since 1991.

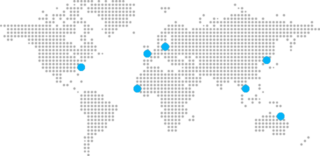

LOCATIONS